Printable 1099 Form Independent Contractor

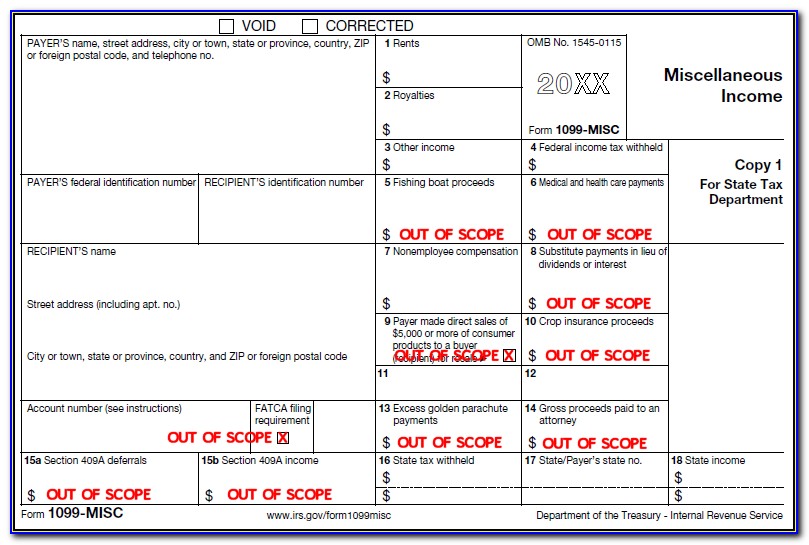

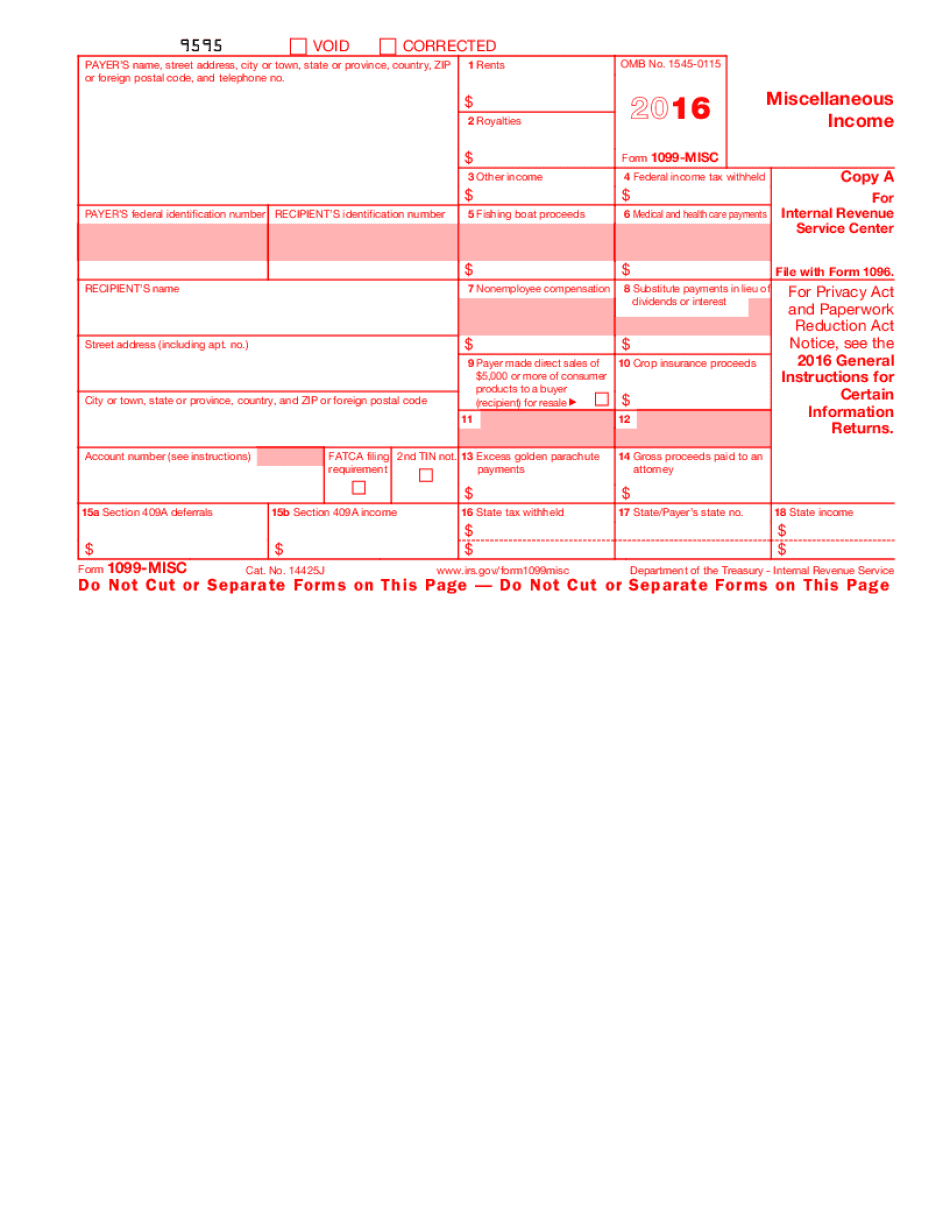

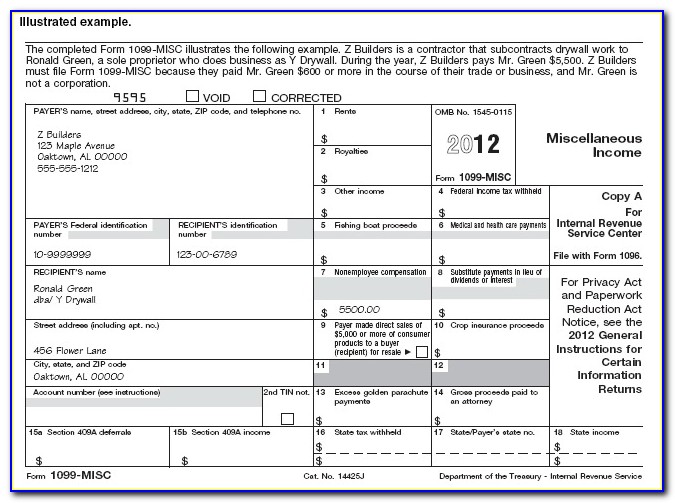

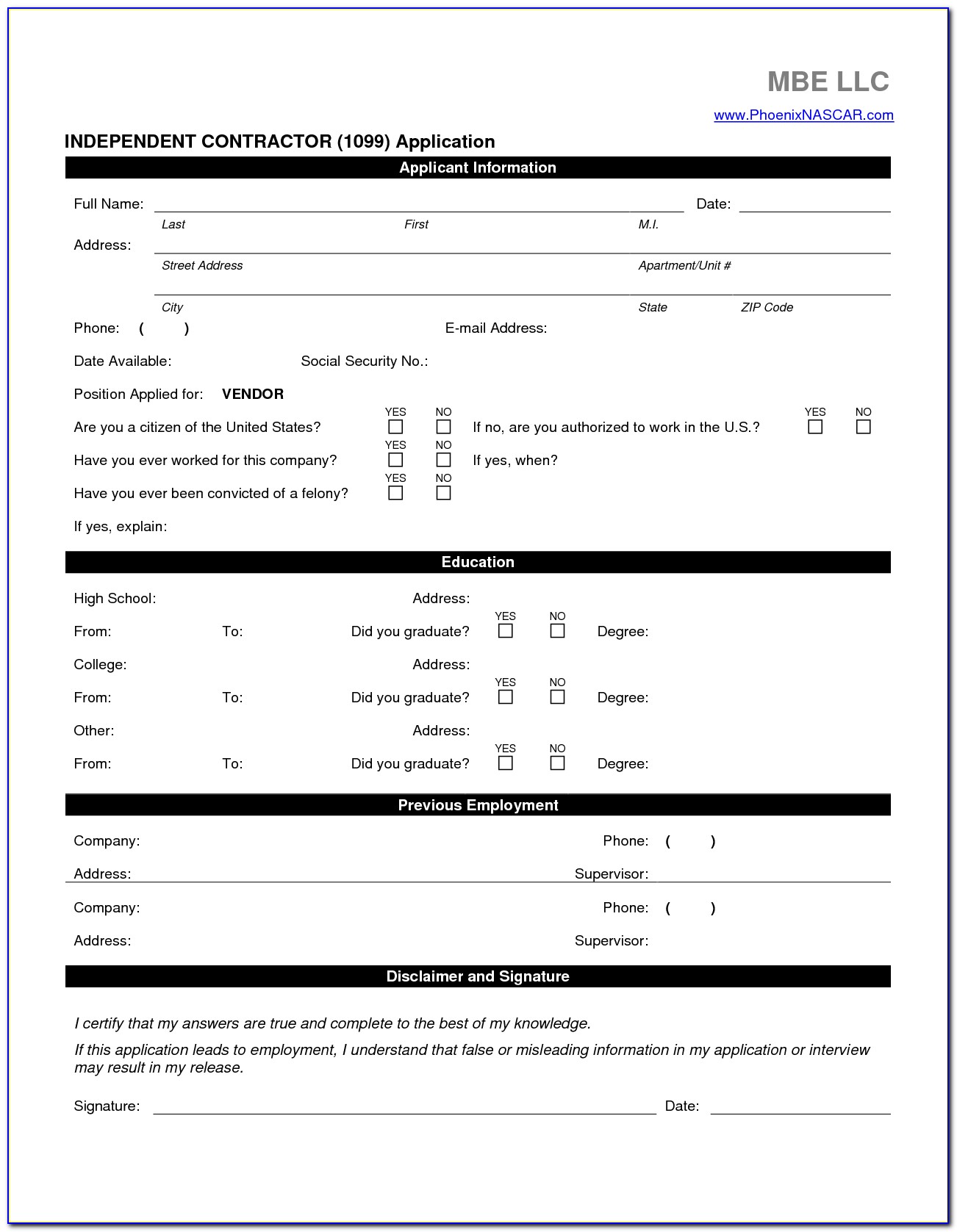

Printable 1099 Form Independent Contractor - Web what is a 1099 independent contractor? Simple instructions and pdf download updated: Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent. A person who contracts to perform services for others without having. Web submit your form 1099 online to the irs by march 31st, 2021. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Completing and filing this tax form is. If payment to the independent contractor is more than $600 over the course of a. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. Web in addition to the irs forms that an independent contractor must file, their clients and employers are required to submit information regarding. There are late penalties for payer’s who file the information returns. A person who contracts to perform services for others without having. Web what is a 1099 independent contractor? Completing and filing this tax form is. Web we have provided you the detailed information about different types of independent contractors who receive a. Web submit your form 1099 online to the irs by march 31st, 2021. There are late penalties for payer’s who file the information returns. Web we have provided you the detailed information about different types of independent contractors who receive a. Simple instructions and pdf download updated: Web the 1099 form must be filed by january 31st of the year. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent. Web submit your form 1099 online to the irs by march 31st, 2021. Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent. Simple instructions and pdf download updated: Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Web march 29, 2023 reviewed by isaiah. Web submit your form 1099 online to the irs by march 31st, 2021. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Web we have provided you the detailed information about different types of independent contractors who receive a. If payment to the independent contractor is more. A person who contracts to perform services for others without having. If payment to the independent contractor is more than $600 over the course of a. Web we have provided you the detailed information about different types of independent contractors who receive a. Web in addition to the irs forms that an independent contractor must file, their clients and employers. There are 20 variants of 1099s, but the. A person who contracts to perform services for others without having. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. There are late penalties for payer’s who file the information returns. Web report payments made of at least $600 in the course of a. Simple instructions and pdf download updated: There are 20 variants of 1099s, but the. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. Completing and filing this. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year. If payment to the independent contractor is more than $600 over the course of a. There are late. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Simple instructions and pdf download updated: Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. Web we have provided you the detailed information about different types of independent contractors who. Completing and filing this tax form is. Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year. Web in addition to the irs forms that an independent contractor must file, their clients and employers are required to submit information regarding. Web we have provided you the detailed information about different types of independent contractors who receive a. There are 20 variants of 1099s, but the. There are late penalties for payer’s who file the information returns. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. If payment to the independent contractor is more than $600 over the course of a. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. A person who contracts to perform services for others without having. Simple instructions and pdf download updated: Web what is a 1099 independent contractor? Web submit your form 1099 online to the irs by march 31st, 2021. Web what is a 1099 independent contractor? Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Web submit your form 1099 online to the irs by march 31st, 2021. Web we have provided you the detailed information about different types of independent contractors who receive a. Web in addition to the irs forms that an independent contractor must file, their clients and employers are required to submit information regarding. A person who contracts to perform services for others without having. There are 20 variants of 1099s, but the. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. If payment to the independent contractor is more than $600 over the course of a. Simple instructions and pdf download updated: Completing and filing this tax form is.1099 Form Independent Contractor Pdf Independent Contractor Invoice

1099 Form Independent Contractor Pdf / 1099 Form Independent Contractor

1099 Form For Independent Contractors 2019 Form Resume Examples

1099 Tax Form Independent Contractor Universal Network

1099 Form Independent Contractor Pdf / Irs Form 1099 Misc Fill Out

1099 Form Independent Contractor Pdf 7 Excel 1099 form Template 93341

1099 form independent contractor Fill Online, Printable, Fillable

1099 Form Independent Contractor Pdf Klauuuudia 1099 Misc Template

1099 Form Independent Contractor Pdf 40 Independent Contractor

1099 Form Independent Contractor Pdf 7 Excel 1099 form Template 93341

There Are Late Penalties For Payer’s Who File The Information Returns.

Web The 1099 Form Must Be Filed By January 31St Of The Year Following The Year In Which You Performed The Work As An Independent.

Web March 29, 2023 Reviewed By Isaiah Mccoy, Cpa If You Hired A Contractor Or Freelancer And Paid Them More Than $600 In A Year.

Related Post:

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)