1099-Nec Printable

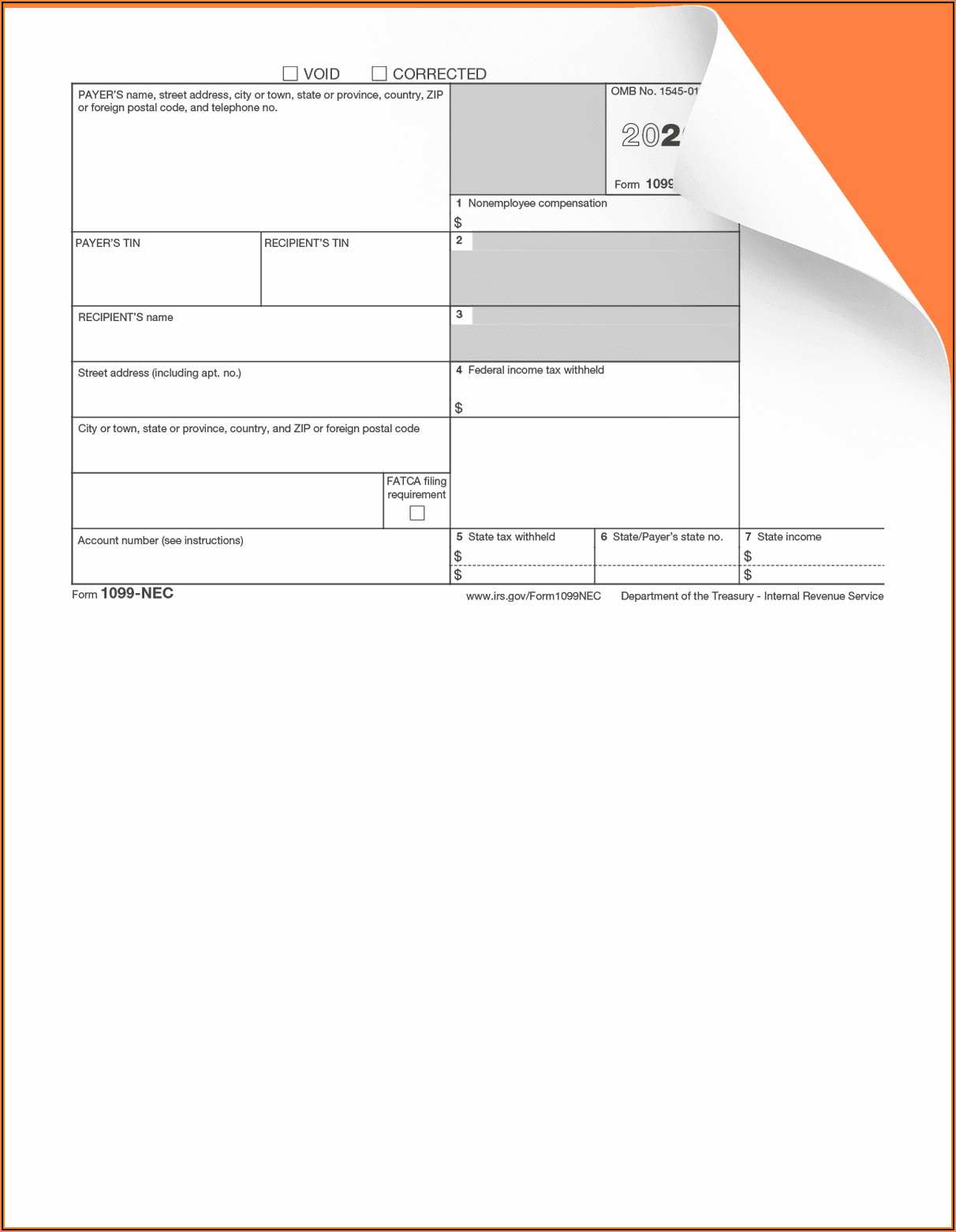

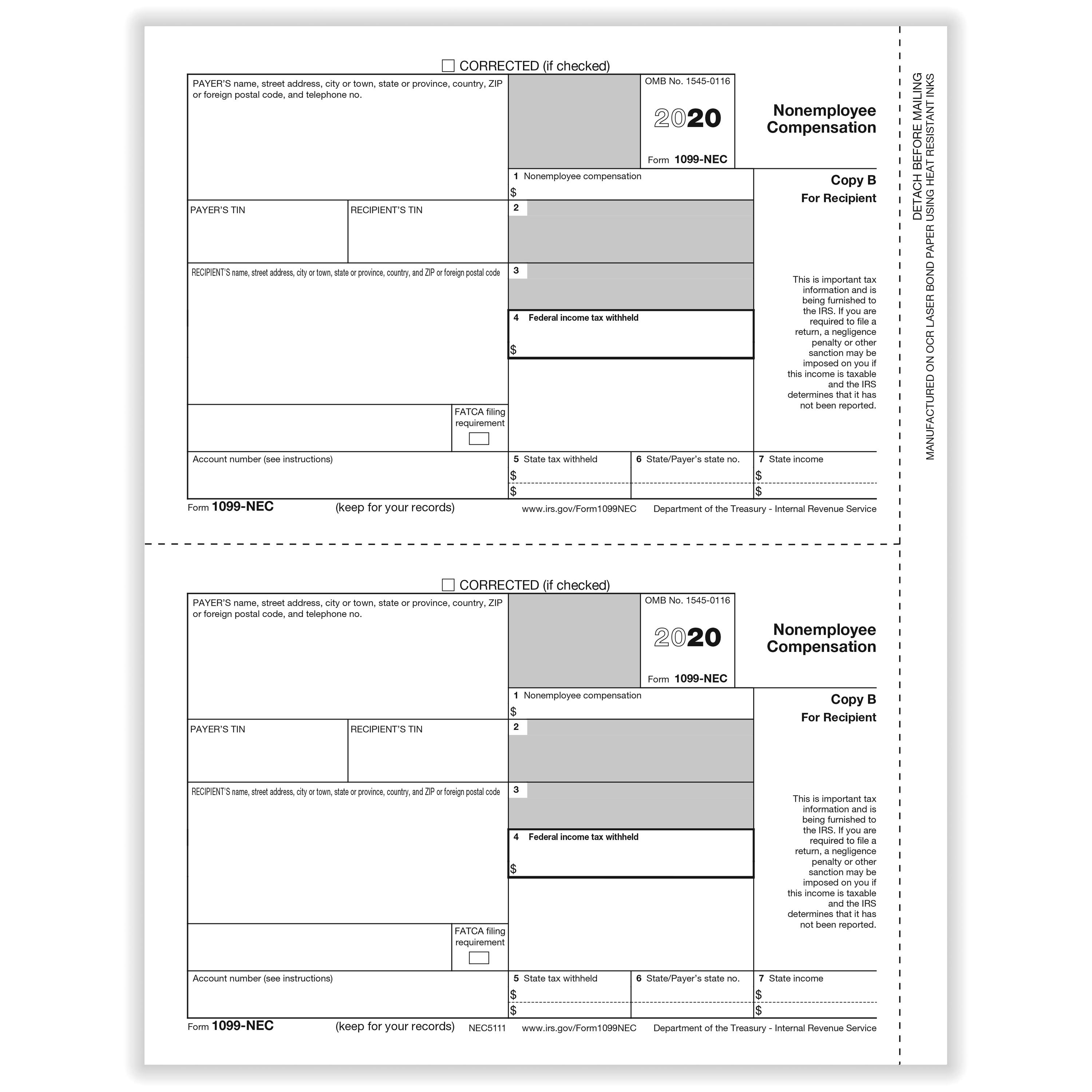

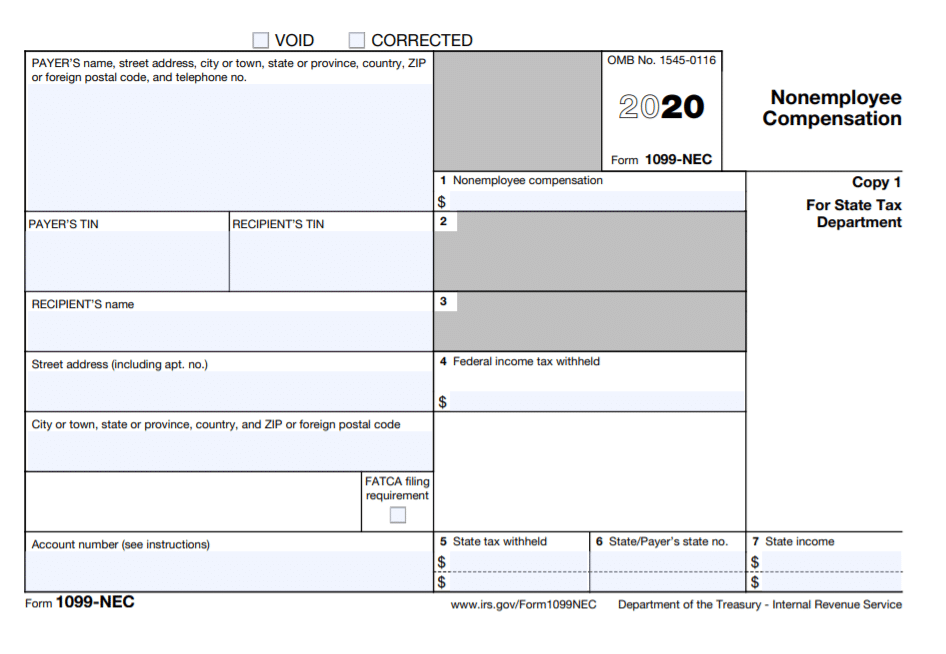

1099-Nec Printable - Fill out the nonemployee compensation. Copy a of this form is provided for informational purposes only. Boxes on the left side of the form require the payer and recipient details such as tin,. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. For internal revenue service center. Copy a appears in red,. Step 2 preview how your document looks and make edits. All businesses must file a. Web step 1 answer a few simple questions to create your document. The payer and the receiver should point their names,. Web 1099, 3921, or 5498 that you print from the irs website. Copy a of this form is provided for informational purposes only. Step 3 download your document. All businesses must file a. Boxes on the left side of the form require the payer and recipient details such as tin,. Copy a of this form is provided for informational purposes only. Fill out the nonemployee compensation. All businesses must file a. The payer and the receiver should point their names,. For internal revenue service center. The payer and the receiver should point their names,. Boxes on the left side of the form require the payer and recipient details such as tin,. For internal revenue service center. Step 3 download your document. Copy a appears in red,. Web step 1 answer a few simple questions to create your document. Web 1099, 3921, or 5498 that you print from the irs website. Furnish copy b of this form to the recipient by february 1,. Copy a appears in red,. All businesses must file a. Step 2 preview how your document looks and make edits. Copy a appears in red,. Copy a of this form is provided for informational purposes only. Fill out the nonemployee compensation. For internal revenue service center. Step 3 download your document. Copy a of this form is provided for informational purposes only. Web step 1 answer a few simple questions to create your document. All businesses must file a. Web 1099, 3921, or 5498 that you print from the irs website. The payer and the receiver should point their names,. Web step 1 answer a few simple questions to create your document. Step 3 download your document. Fill out the nonemployee compensation. For internal revenue service center. Copy a appears in red,. Copy a of this form is provided for informational purposes only. Boxes on the left side of the form require the payer and recipient details such as tin,. Furnish copy b of this form to the recipient by february 1,. Step 3 download your document. Web step 1 answer a few simple questions to create your document. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. Step 2 preview how your document looks and make edits. Copy a appears in red,. Copy a. The payer and the receiver should point their names,. Step 3 download your document. Copy a of this form is provided for informational purposes only. All businesses must file a. Boxes on the left side of the form require the payer and recipient details such as tin,. Boxes on the left side of the form require the payer and recipient details such as tin,. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. Web step 1 answer a few simple questions to create your document. The payer and the receiver should point their names,. Step 2 preview how your document looks and make edits. Furnish copy b of this form to the recipient by february 1,. Fill out the nonemployee compensation. All businesses must file a. Copy a appears in red,. Web 1099, 3921, or 5498 that you print from the irs website. For internal revenue service center. Step 3 download your document. Copy a of this form is provided for informational purposes only. Copy a of this form is provided for informational purposes only. For internal revenue service center. Furnish copy b of this form to the recipient by february 1,. Web step 1 answer a few simple questions to create your document. Boxes on the left side of the form require the payer and recipient details such as tin,. Copy a appears in red,. All businesses must file a. The payer and the receiver should point their names,. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. Step 3 download your document.What the 1099NEC Coming Back Means for your Business Chortek

Understanding 1099 Form Samples

Fill out a 1099NEC

What Is Form 1099NEC?

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN

How to File Your Taxes if You Received a Form 1099NEC

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

1099NEC Recipient Copy B Cut Sheet HRdirect

Form 1099NEC Nonemployee Compensation, Recipient Copy B

Form1099NEC

Step 2 Preview How Your Document Looks And Make Edits.

Fill Out The Nonemployee Compensation.

Web 1099, 3921, Or 5498 That You Print From The Irs Website.

Related Post:

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)